Recently the Prime Minister and the Treasurer have indicated what the JobKeeper program will look like moving forward after September 2020 through to 20th March 2021.

For those that are currently on JobKeeper, the current arrangements will be staying in place to September 25th, that’s when things are changing.

Beyond September 25th 2020 until March 20th 2021, the Government has brought out the new two tier system at a lower rate for businesses who may be eligible. The reason they are doing this as they know many businesses are doing it tough, but not to completely cut off funding, they have reduced and brought in this system, which personally I feel is extremely generous, as the Government could have stopped the payments after September 2020.

1. But who is eligible?

If you need assistance and not sure, this is where I can assist and help you.

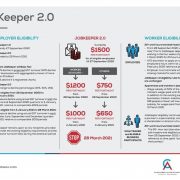

To apply for JobKeeper 2.0 support for the quarter ending 27th December 2020, a business will need to meet the required downturn (30% or more) for both the June 2020 and September 2020 quarters.

To apply for the following quarter, ending 28th March 2021, a business will need to meet the downturn (30% or more) for each of the June 2020, September 2020 and December 2020 quarters.

2. So will the JobKeeper payments be reduced?

The answer is YES.

After September 25th 2020, the current rate of $1500.00 per employee payments will no longer apply. In the next phases there will be two tiers of payments and reductions each quarter.

The first level will be for people working 20 hours or more a week.

The payments for these employees will be reduced to $1200 per fortnight for the Dec 2020 quarter and further reduced to $1000 per fortnight for the Mar 2021 quarter

The second level will be for people working less than 20 hours a week.

The payments for these employees will be reduced to $750 per fortnight for the Dec 2020 quarter and further reduced to $650 per fortnight for the Mar 2021 quarter.

This is in line with new changes to the JobSeeker payments.

The exact details around these changes are of course still to be legislated, and as a result subject to change, but this is what we know now.

Of course, if you have any questions, please don’t hesitate to contact us.

Maree Punzet | Maree’s Mobile Bookkeeping | 0429 363 047

You didn’t go into business to do your Payroll and Bookkeeping, BUT WE DID

We are a full service, insourced Payroll and Bookkeeping business that puts money back in your pocket. Our team works like a full-time employee and part of your business when it comes to processing your Payroll and bookkeeping, but without the cost or other concerns full time employees bring. When compared to a full-time employee, we give you all the benefits and more but save you around $60,000 a year in costs, makes good financial sense!!